Industry Insights

This collection of the latest updates and data from the systems integration industry explores leading indicators including the CEO Confidence Index, Purchasing Managers Index, and CSIA updates. We offer our own insights based on the information referenced and interactions with Exotek clients and the SI community.

Plummets Amid Tariff Uncertainty 4.6 (-0.4)

- 67% Do not support tariff policies

- 76% Say it will hurt their businesses

- 62% Forecast a slowdown or recession within 6 months

- Revenue = 49% (-6)

- Profits = 37% (-6)

- CapEx = 26% (-11)

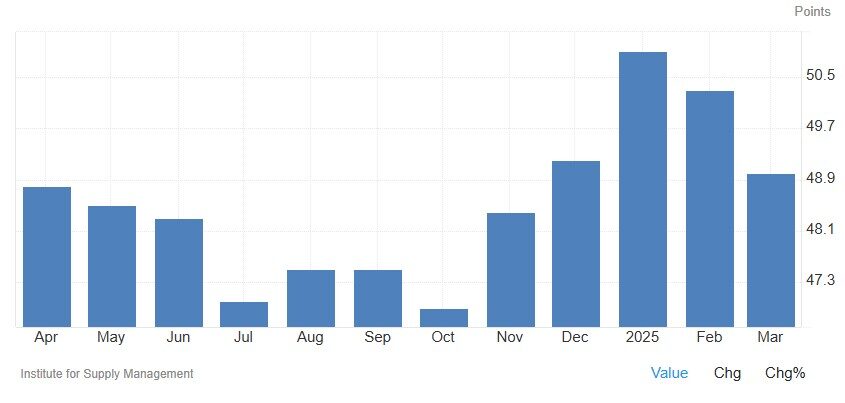

49.0% (-1.3), Moving Back into Contraction

- New Orders and Backlogs Contracting

- Production and Employment Contracting

- Supplier Deliveries Slowing

- Raw Materials Inventories Growing

- Customers’ Inventories Too Low

- Prices Increasing

- Exports Contracting and Imports Growing

CEO and PMI Indices

The latest CEO survey revealed significant monthly declines in outlook for revenues, profits, capital expenditures, and hiring, all of which have sharply decreased since March. Regarding inflation, 81% of surveyed CEOs anticipate an increase in the cost of goods, services, and labor this year compared to last year, with half expecting double-digit increases.

Manufacturers are urgently trying to mitigate the effects of tariffs, while consumers are understandably worried about how these tariffs will affect their purchasing power. This atmosphere of fear, uncertainty, and doubt is already having an impact on some SI projects.

Systems integrators should seize the opportunity to monitor shifts in capital spending and prioritize operational expenditure (OPEX) spending. Their customers will be focused on cost reduction and efficiency improvements.

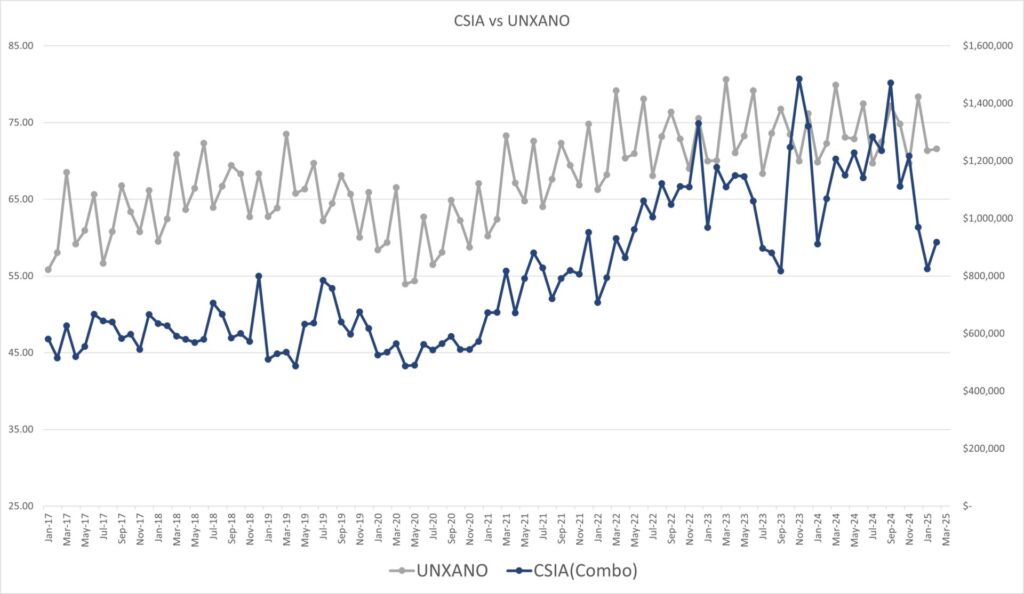

Exotek Insights – CSIA vs UNXANO Analysis

We have transitioned from tracking US Capital Goods New Orders (USCGNO) to Non-Defense Capital Goods Excluding Aircraft (UNXANO). This shift better aligns with the focus of most system integrators and provides a clearer indication of actual capital spending.

Our Key Takeaways

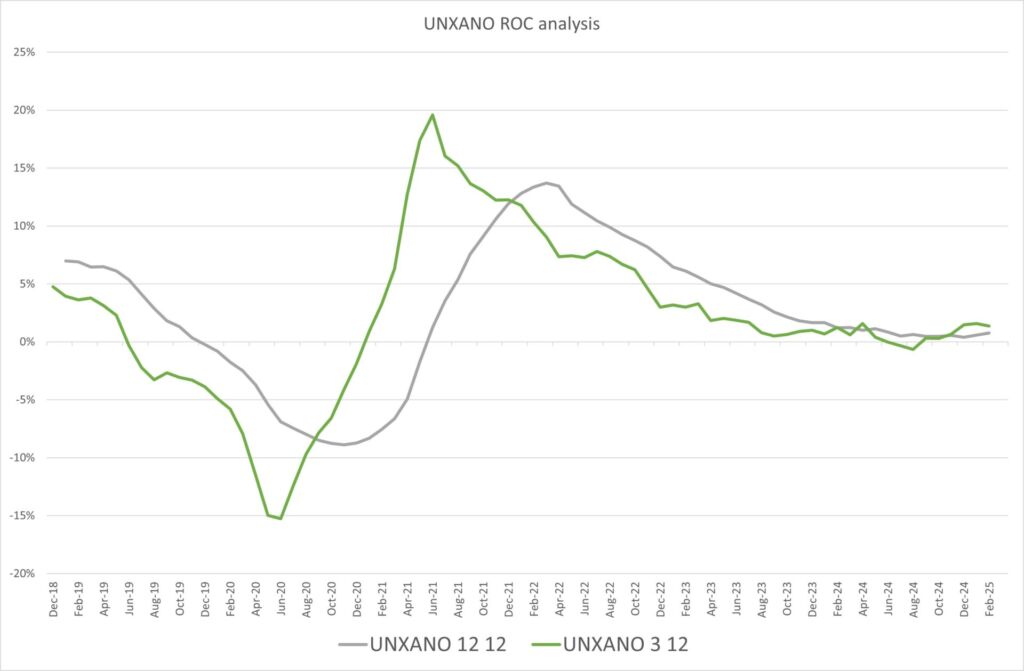

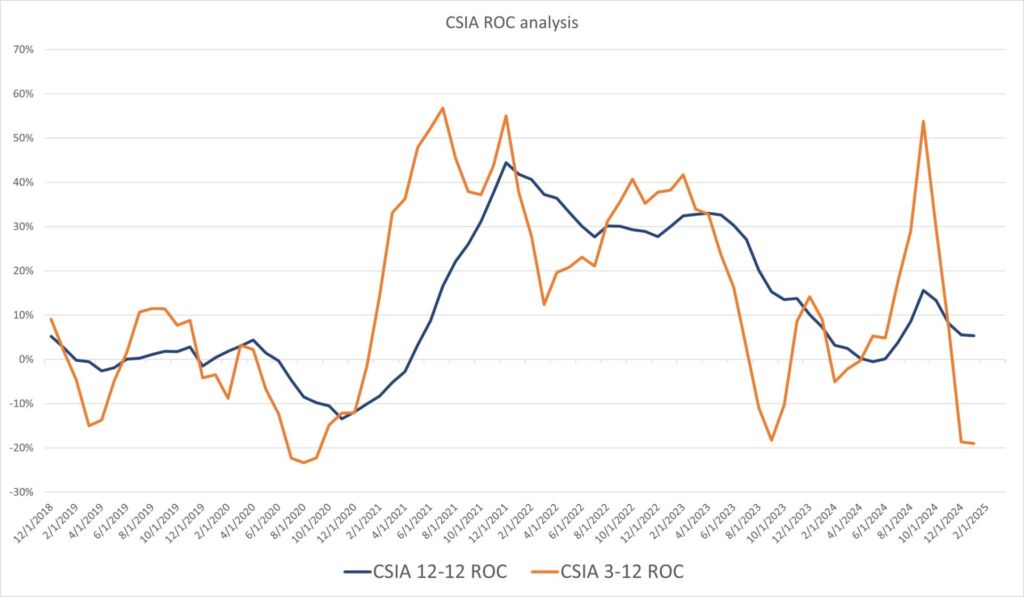

ROC Analysis

The UNXANO has remained stagnant since late summer 2023 and began slowing in January 2021. On a positive note, spending remains at a high level. However, recent announcements have added to the uncertainty, making an uptick unlikely in the near future.

System integrators faced a significant slowdown last year, even entering the contraction zone. The second half showed promise with the 3/12 crossing above the 12/12, but the year ended with the 3/12 crossing back down over the 12/12 significantly. This suggests that we can expect very low growth to contraction in the near future. The ROC analysis for CSIA members is somewhat distorted due to the high revenue month in December, when end users typically spend the remainder of their approved budgets.

Our Key Takeaways

After a slow end to the year for our SI community, the new year has started with mixed results. Larger SIs (in the top quartile) are outperforming their 2024 benchmarks in the first two months, while mid-size and smaller integrators are slightly lagging behind last year’s performance. Revenue recognition in Q1 is often challenging as new projects are just getting underway. We’ll keep a close eye on the progress of these new projects.

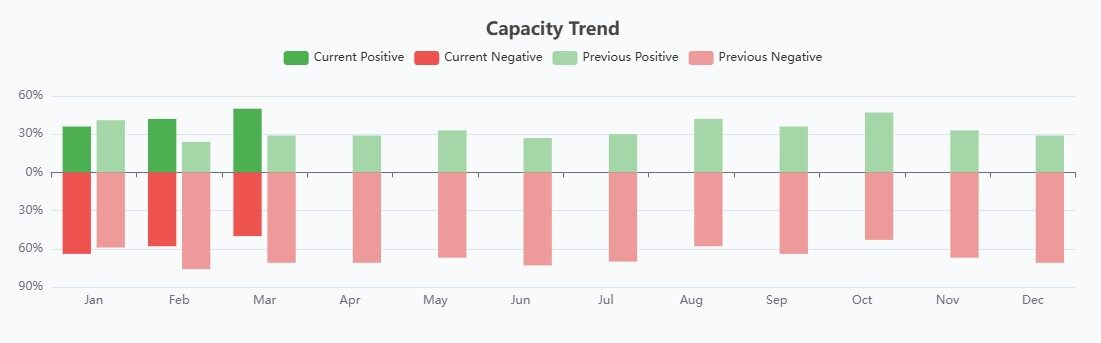

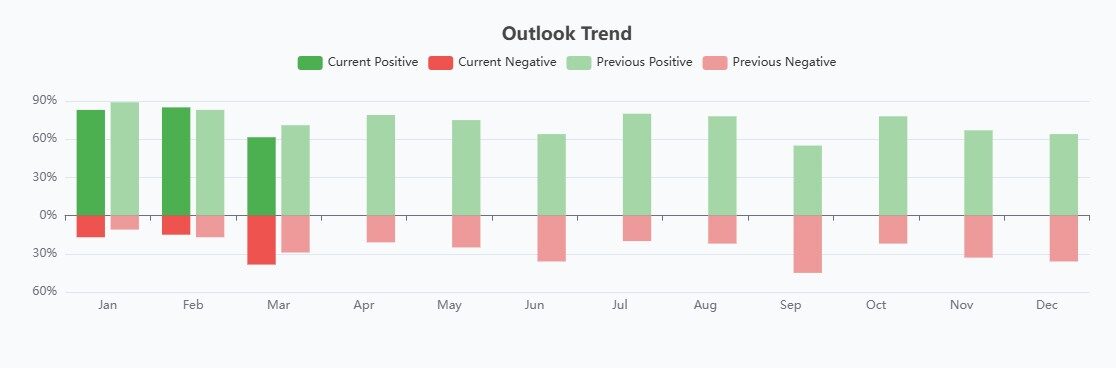

As the new year projects kick off, capacity is trending positively, with more SIs reporting they are at full capacity and unable to take on additional work. However, the overall outlook from our SI community has dropped 14 points to a long-time low, with only 62% having a positive outlook. The ongoing tariff situation seems to be a significant concern.

Our Key Takeaways

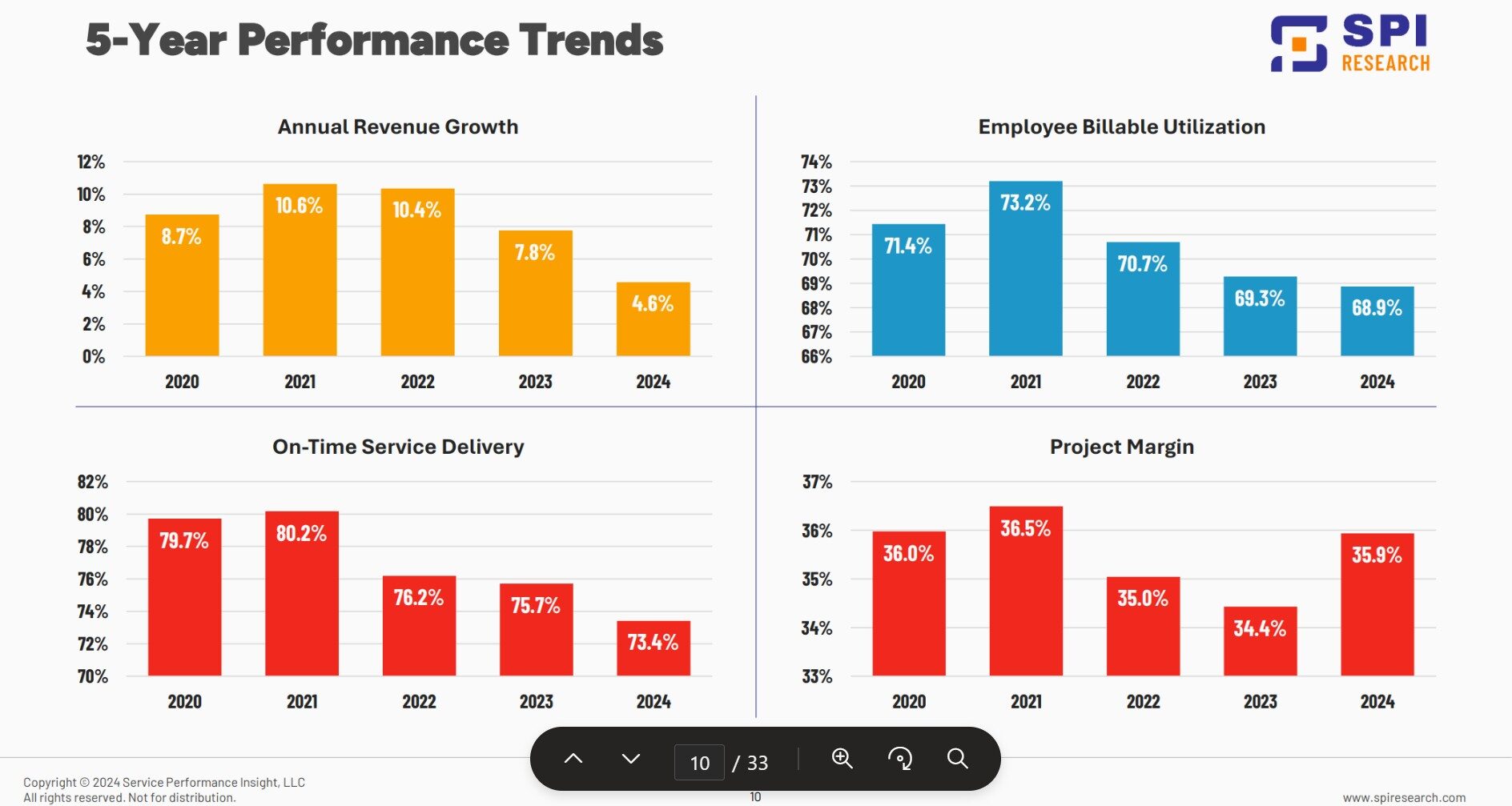

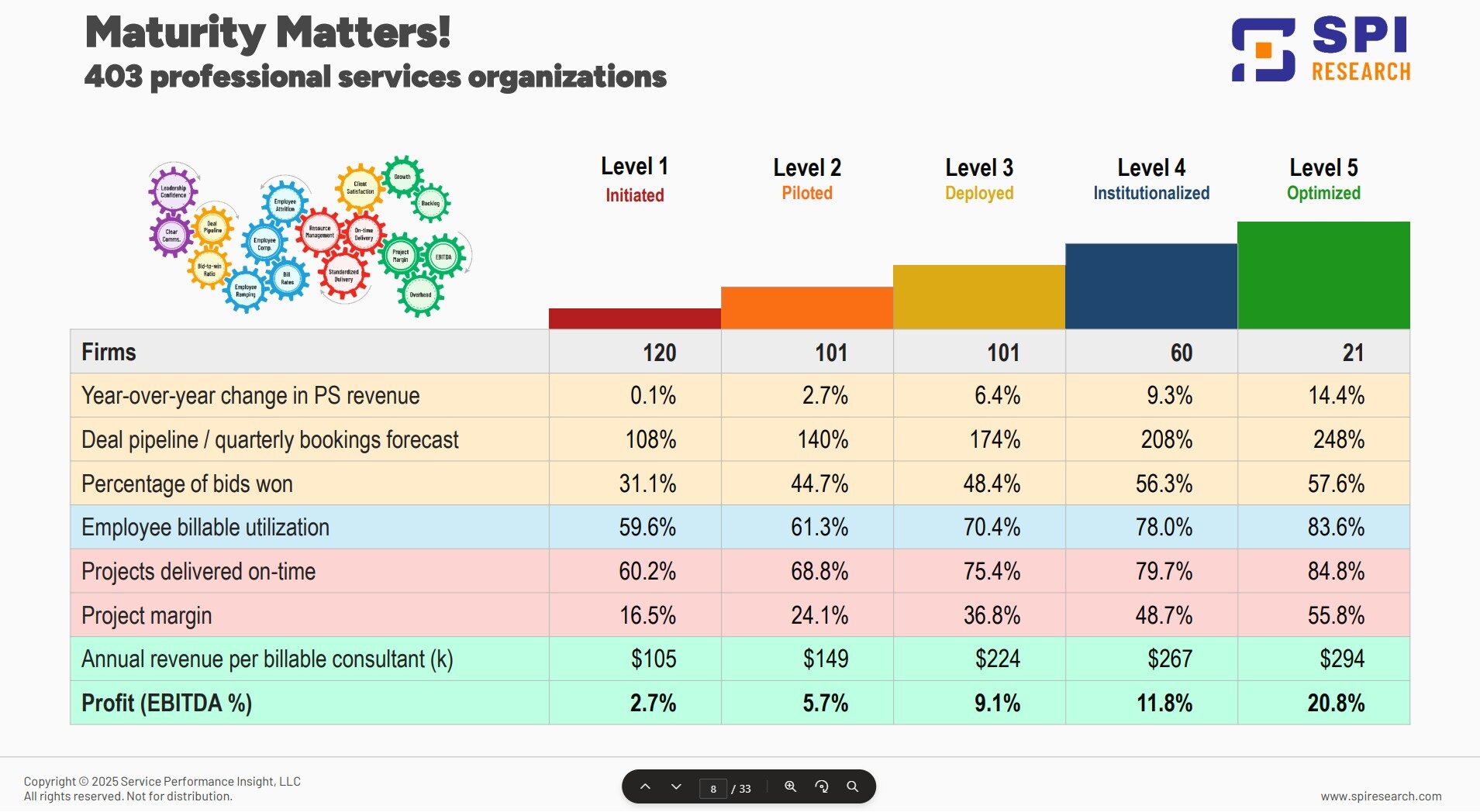

The last three years have been increasingly difficult for professional services firms, with revenue and utilization trending downward. Interestingly, firms that focus on improving their maturity level to institutionalized or optimized tend to perform better across almost every measure. This highlights the importance of implementing CSIA Best Practices.